June’s currency update

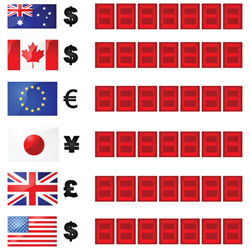

Since the euro’s rebound in mid-March it has been looking reasonably chipper. In April it was in the leading group of major currencies, strengthening by five eighths of a cent against sterling and the Australian dollar and taking four and a quarter cents off the back marker, the US dollar.

It was not so much a case of euro success, more one of failures elsewhere. The economic data coming out of the States failed to demonstrate the vitality necessary to encourage an early interest rate increase from the Federal Reserve. America’s gross domestic product expanded only by the smallest measurable fraction in the first quarter and only half the expected number of jobs were created in March. First quarter growth in Britain also failed to meet expectations, with gross domestic product increasing by a disappointing 0.3%.

By contrast, some of the ecostats from Euroland were more positive than investors had become accustomed to. Perhaps the most helpful statistic was the latest provisional consumer price index measure, which put inflation at 0.0%. In just a couple of months euro zone inflation has covered the gap between -0.6% and zero. Whilst that is still a long way from its 2% target it is beginning to look as though the demon of deflation has been slain.

Next on the hit list will presumably be the demon of Grexit, which looms larger today than it did a month ago. Back then around a third of investors expected Greece to default and leave the euro. A poll by Bloomberg last week found that proportion had risen to 52%.

The Greek government has certainly given them every reason to fear the worst. The finance minister is on record as saying he would default to the country’s external creditors before he would default to his own people: he would rather pay the wages of public sector workers than repay loans from the Troika (or “The Institutions” as he prefers to refer to them). And as Greece depletes its dwindling cash reserves that might indeed be the choice.

For sterling’s value against the euro the clear and present danger is Thursday’s general election. The polls continue to indicate a hung parliament and another five years with no single party in control. It is far easier to imagine a result unhelpful to sterling than one which has a positive effect on the pound.

For more information about these and the other options that are available to help send money to and from France as efficiently as possible call the experienced and friendly team at Moneycorp. You can call straight through to the trading floor on 0044 20 7589 3000 and quote “Sextant” to benefit from great rates and first transfer free (usually £15 over the phone and £9 online).

.

| What next? |

|---|

Call +44 (0) 20 7589 3000 (Open 7:30am – 9pm Monday 9am to 1pm Saturday to Friday UK Time)

> Open a Currency account today

> Ask questions about Currency Exchange

Moneycorp are Sextant French Properties preferred currency partner and have been selected due to their great rates, great service and great solutions. These are some of the reasons they have transacted over two billion pounds for their clients.

Moneycorp has been in the business of moving money between countries and currencies for over 30 years and offers money-saving foreign exchange to customers ranging from blue-chip businesses to private individuals. We make money transfers simple and help you to manage foreign exchange rate movements.

Moneycorp also offer a number of different contract options for Sextant clients including a forward contract where you can fix a rate of exchange for a period in the future using just a small deposit, perfect to help take the risk out of the currency markets and budget for your French property purchase.